After a relatively stable 2024, the Belgian property market recorded a record year in 2025, with a general increase in the number of sales across the country. This growth was largely driven by the reduction of registration duties in Flanders (from 3% to 2%) and especially in Wallonia (from 12.5% to 3%).

In Brussels, transactions rose by +7.1% in 2025, confirming a return to a more dynamic market. Brussels also remains the most expensive region in Belgium for houses, ahead of Flanders and well above Wallonia.

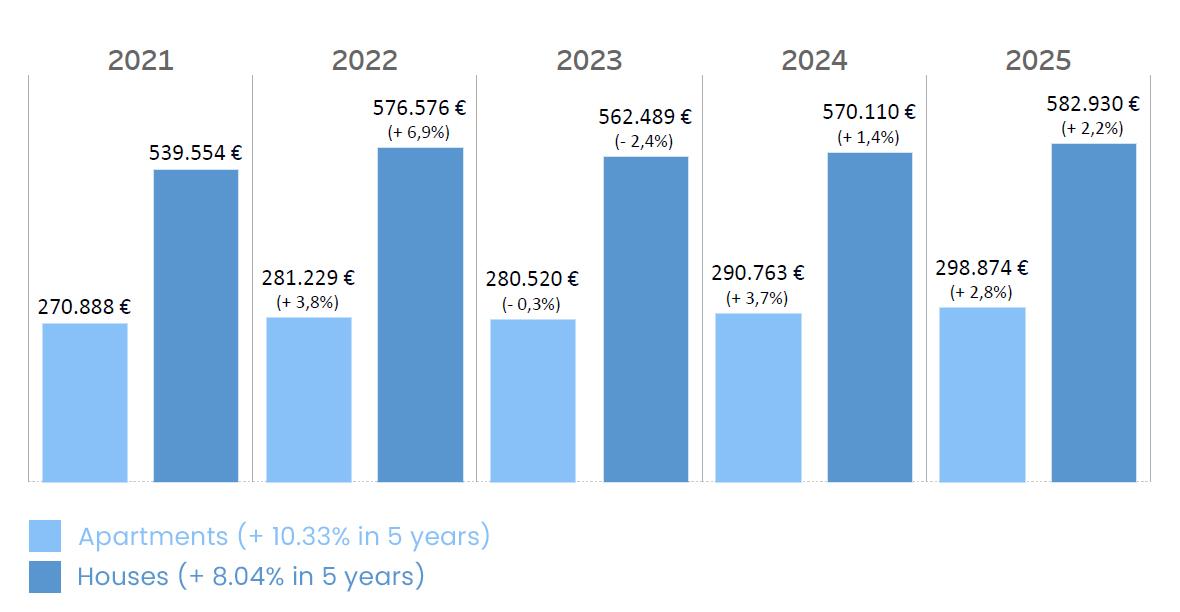

🏡Market prices in Belgium and Brussels

Houses:

- Belgium: €348,800 (+5.8%)

- Brussels: €582,930 (+2.2%)

- Wallonia: €270,790 (+13.4%)

- Flanders: €380,655 (+3.6%)

Apartments:

- Belgium: €277,927 (+2.4%)

- Brussels: €298,874 (+2.8%)

- Wallonia: €209,342 (+5.4%)

- Flanders: €289,157 (+2.3%)

New-build vs existing apartmentsIn Brussels in 2025:

- New-build apartment: €366,429

- Existing apartment: €298,208

The price of a new-build apartment in Brussels therefore exceeds the average price of a house (€348,000). However, the share of new-build properties remains limited: high prices and the VAT framework have slowed projects in recent years. The confirmation of the 6% VAT rate for certain projects could nevertheless revitalise the new-build market.

Prices remain higher in Brussels, but the increase is more moderate than in other regions, where the reduction in registration duties has strongly stimulated the market (especially in Wallonia). The apartment market is growing slightly faster than the market for houses, driven by a rising demand among young buyers (18–35 years old).

Brussels remains a contrasting market

The regional average price hides significant disparities between municipalities:

- Some municipalities (Woluwe-Saint-Pierre, Uccle, Ixelles…) often exceed €700,000 for a house.

- Other, more popular municipalities (Molenbeek, Anderlecht…) remain far more affordable.

For more details about property prices in Belgium, you can consult the notaries’ barometer.

Real estate price trends in Brussels

House prices

Average house prices in Brussels (2024)

| Commune | Price | |

| 1 | Woluwe-Saint-Pierre | € 761,398 |

| 2 | Watermael-Boitsfort | € 736,446 |

| 3 | Ixelles | € 721,855 |

| 4 | Uccle | € 720,457 |

| 5 | Woluwe-Saint-Lambert | € 714,824 |

| 6 | Etterbeek | € 709,312 |

| 7 | Forest | € 636,733 |

| 8 | Saint-Gilles | € 607,500 |

| 9 | Auderghem | € 545,189 |

| 10 | Schaerbeek | € 526,617 |

| 11 | Jette | € 497,489 |

| 12 | Bruxelles | € 477,173 |

| 13 | Evere | € 416,483 |

| 14 | Berchem-Sainte-Agathe | € 414,366 |

| 15 | Ganshoren | € 409,188 |

| 16 | Saint-Josse-Ten-Noode | € 403,208 |

| 17 | Anderlecht | € 394,463 |

| 18 | Molenbeek-Saint-Jean | € 376,298 |

| 19 | Koekelberg | - |

Source: notaire.be

Average appartment prices in Brussels (2024)

| Commune | Prix de vente | |

| 1 | Woluwe-Saint-Pierre | € 410,156 |

| 2 | Ixelles | € 378,355 |

| 3 | Uccle | € 378,206 |

| 4 | Woluwe-Saint-Lambert | € 342,002 |

| 5 | Watermael-Boitsfort | € 339,925 |

| 6 | Saint-Gilles | € 337,149 |

| 7 | Auderghem | € 336,233 |

| 8 | Etterbeek | € 319,371 |

| 9 | Forest | € 294,366 |

| 10 | Bruxelles | € 290,505 |

| 11 | Schaerbeek | € 270,771 |

| 12 | Saint-Josse-Ten-Noode | € 258,791 |

| 13 | Evere | € 242,361 |

| 14 | Berchem-Sainte-Agathe | € 234,323 |

| 15 | Molenbeek-Saint-Jean | € 225,983 |

| 16 | Jette | € 221,390 |

| 17 | Koekelberg | € 219,401 |

| 18 | Anderlecht | € 214,844 |

| 19 | Ganshoren | € 214,556 |

Source: notaire.be

👥 Who’s buying in Brussels?

Young buyers (18–35 years old) represent a growing share of the apartment market:

They accounted for 41% of buyers in Belgium in 2025 (vs 35% in 2021).

This trend is also visible in the Brussels-Capital Region, where apartments are often the entry point to home ownership: they account for around 70% of transactions. The average age of buyers is around 40.

🏢 How about rents?

The average rent in Brussels was estimated at €1,321 in the first half of 2025, up 5% compared with 2024.

Rental activity concerns mainly apartments (90% of cases).

Woluwe-Saint-Pierre remains the most expensive municipality in the capital, while Jette, Ganshoren and Anderlecht still show average rents below €1,000.

- What’s new?

Since 1 May 2025, the Brussels-Capital Region has tightened rent control. If the rent requested exceeds the calculated reference rent by more than 20%, it is presumed to be abusive. In such cases, the burden of proof lies with the landlord. An update of the reference rent grid is planned for 2026, as current data dates from 2017 to 2020.

To find the applicable reference rent for a dwelling, you can use the simulator on loyers.brussels. Simply enter the address, surface area, number of bedrooms and other characteristics to obtain an estimate. - Since 6 January 2024, tenants in Brussels also benefit from a pre-emption right when the rented property is put up for sale. This means that the owner must first offer the property to the tenant, who may freely decide whether or not to exercise this right.

🧭 How to buy?

Would-be buyers have several options: private sale, public sale or online sale.

In the case of a private sale, the vendor and buyer agree the price of the property, at which point the sale is fixed. They sign a preliminary purchase agreement which, following the necessary checks, is then finalized in a notarial deed. On top of the agreed purchase price, the buyer has to pay registration duties (12.5% in Brussels), as well as notary’s fees and administrative costs, making a total of 14–15%.

Public and online sales (www.biddit.be) are auctions overseen by a notary. If accepted by the seller, the highest bid seals the purchase. Once again, you have to add a flat fee of about 14–15% to the purchase price. Not only are sales like this safe and free of surprises, they also have the advantage of being simpler and faster (in the case of an online sale, it only takes a few weeks to become the new owner).

One thing you always have to keep in mind is that, regardless of your chosen formula, as soon as you sign a preliminary agreement or submit an offer, you are making a binding commitment to the vendor. So before you embark on this adventure, you really need to know how much you can afford.

If you use the online simulation tool offered by KBC Brussels, you’ll know in just 15 minutes whether or not your project is affordable:

How to finance your purchase?

Even if you have your own funds, it is always advisable to finance at least part of your purchase through a loan (in the shape of a mortgage). This has several advantages:

- You retain a financial buffer to deal with unexpected events or investment opportunities.

- The interest payments on your mortgage loan are tax-deductible.

- Interest rates are still affordable

As the Brussels experts, we can offer you personalized advice on the best KBC Brussels mortgage to finance your purchase of a property in the capital.

💵 Grants and subsidies in Brussels

Various forms of assistance are in place to help you achieve your property plans in Brussels. Each one depends on your specific situation and the nature of your project. The main ones are set out below:

Stamp duty reduction for the first 200,000 euros

Still available in 2026:

- a stamp duty reduction on the first 200,000 euros of the property price.

- Potential savings: 25,000 euros (200.000 x 12.5% duty)

- Conditions: property in Brussels, main residence, no other real estate, purchase price under €600,000

More info: Stamp duty reduction– Brussels Taxation (fiscalite.brussels) (French)

Renolution: a subsidy system on hold?

Since March 2022, the energy grants, renovation grants and façade improvement grants have been merged into a single system: the Renolution premiums, accessible via IRISbox, the digital portal of the Brussels-Capital Region.

However, these premiums were called into question in 2024. Due to a significant overspending of the allocated budget, they were first suspended and later reactivated, but only for ongoing applications. As of early 2026, with Brussels still awaiting a new government, the future of the Renolution premiums remains uncertain and the scheme has been suspended.

👉 More information on Renolution website (French/Dutch)

Reduced VAT for demolition/rebuilding

On 1 January 2024, definitive new VAT rules entered into force throughout Belgium.

The reduced 6% VAT rate now applies only to property work in relation to the demolition of a building and the rebuilding (or first-time building) of a residential building on the same plot, for use as the project owner’s own home or for social housing. The “social conditions” that must be met, for either five or fifteen years, under the temporary rules to qualify for the reduced VAT rate (building must be the sole dwelling owned by the project owner, have a habitable area not exceeding 200 m2, and be your home, or a residential building for social housing rental) remain in force under the definitive rules.

👉 More info: new measure for demolition-rebuilding (French)