Verification of Payee and instant credit transfers

- Make transfers more securely

- Prevent fraud and errors

- Choose the fastest method (24/7 on any calendar day)

New Instant Payments Regulation: how will this affect you?

All euro area banks perform an additional check in which they verify the beneficiary name, otherwise known as ‘Verification of Payee’. KBC Brussels also checks whether the name and account number of your beneficiary match the details in the beneficiary bank’s records. We do this for all traditional and instant credit transfers.

Within five seconds, you will be informed whether the payment was successful. If there’s a problem, you’ll be notified and you can choose what to do next – you can check the beneficiary's details and update them, or continue with the transfer.

This scheme is part of the new Instant Payments Regulation and is aimed at enhancing security for transfers and preventing fraud and incorrect transfers.

Our demo video explains exactly how the check works and the notifications you can receive, and you can read our frequently asked questions for further details.

2. Instant credit transfer: make transfers faster

An instant credit transfer means the money is deposited into the beneficiary's account immediately , 24/7 (i.e. including at night, on weekends, public holidays and bank holidays). You transfer is processed as a instant credit transfer as standard. If you would prefer a traditional credit transfer, you can indicate this in the settings.

You’ll see if your instant credit transfer goes through within 10 seconds. If your instant credit transfer doesn’t go through, you choose what to do with the payment: you can make a traditional credit transfer or cancel the payment. In other words, you’re always in control of the speed of your transfer.

Check our frequently asked questions for even more information about instant credit transfers.

If you’re self-employed or you have your own company, take a look at our page for businesses, where you can find more answers to your questions.

Frequently asked questions about Verification of Payee

No additional costs are charged for checking the name and account number at the beneficiary bank.

All KBC Brussels customers who use our digital applications (such as KBC Brussels Mobile, KBC Brussels Touch, KBC Brussels Online for Business) use this service automatically.

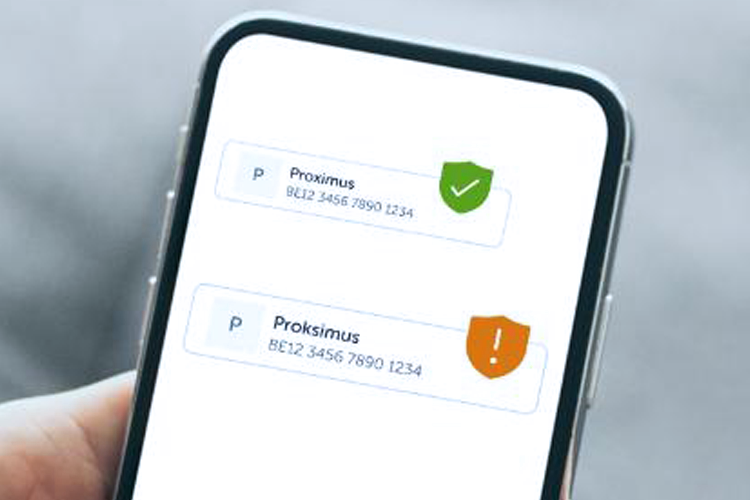

After a transfer, you will receive one of the following three notifications: a green, orange or grey notification shaped like a shield.

Green notification

When you see a green notification when transferring money to a person or a company, it means the name and account number you entered match the details in the beneficiary bank’s records. We perform this additional check to confirm whether the details are accurate and it is safe for you to transfer the money.

Orange notification

The name and the account number do not match. This can mean two things:

- The details are a close match: you will receive an orange notification if the beneficiary’s name differs slightly from the name in the beneficiary bank’s records. Perhaps there was a typo in the information you entered: for example, ‘Jansens’ instead of ‘Janssens’. The notification will contain a suggestion for the correct name. Always check whether the name suggested is the correct name.

- The details are not a match: you will also receive an orange notification if the name and account number you entered do not at all match the details in the beneficiary bank’s records.

Grey notification

In certain cases, we may be unable to check whether the name and account number entered match the details in the beneficiary bank’s records.

You can receive a grey notification for various reasons:

- We, our partner performing the check or the beneficiary bank could be experiencing technical difficulties.

- It may also be the case that the beneficiary bank doesn’t offer this additional check yet or the account may have only just been opened.

Always check the name and the account number.

If you continue with the transfer without making any changes, the amount could be sent to the wrong beneficiary. You will be liable for the transfer if it is fraudulent.

What to do if you suspect fraud or have doubts about a payment

If you’ve fallen victim to fraud or suspect this might be the case, it’s important that you immediately contact Secure4u, our fraud department. You can call them 24/7 on 016 432 000.

Checking the name entered takes no more than five seconds. You will usually receive a notification straight away.

Transfers to personal accounts

- Be sure to enter at least the surname in the beneficiary field

- Contact the person or company you are transferring money to and ask for the full name of the person or company

Transfers to business accounts

Check the details and, if necessary, contact the beneficiary (note that contact details on a forged invoice may also be fake).

Yes, you can. You always decide whether to proceed with the transfer. We do note that, if you choose to proceed with the transfer after receiving an orange or a grey notification without changing any details, you will be liable for the transfer if it is fraudulent.

For private individuals, we will check the surname and first name of all account holders (in other words, the people linked to the account). In case of a typo, we will only show the name of the account holder whose name you entered.

For legal entities, we will check the legal names registered with the beneficiary bank as well as any legal abbreviations registered with the bank.

If you hand in a transfer form at your KBC Brussels branch after November 2025, your transfer will not be checked. In exceptional cases, if we process the transfer, we will check the beneficiary’s name while you’re there.

Yes, it is. Before signing the transfer, you will receive a notification informing you whether the name linked to the account number matches the name the beneficiary bank has on record.

That depends on the situation.

- We will never show the name of a private individual when you only enter the account number for a transfer. Only if there are slight differences in the name, for instance if it contains an obvious typo, do we show the name the beneficiary bank has on record (for example, ‘Jansens’ instead of ‘Janssens’).

- For transfers to legal entities, we will show the legal name.

No, it doesn’t. Erroneous collections can be refunded on request up to 8 weeks after the amount has been debited and, in the event of fraud, up to 13 months after the amount has been debited.

- Foreign-currency payments

- Bank card payments

- If the beneficiary’s IBAN number and name are not manually entered by you

- Direct debits

Yes, it is. The check is performed when setting up the standing order.

- Please note that once you’ve signed the order, we do not perform the check on any subsequent transfers.

- Standing orders set up in the past are not subject to this check either. The check is only performed when setting up the order.

No, the check is only performed on SEPA credit transfers. This means that transfers in currencies other than the euro are not subject to this check.

Yes, it is. The payer's bank checks whether your name corresponds with the account number. If money is credited to your account that is meant for someone else and the payer uses the other person's name, an orange shield will appear. When your payer sees this notification, they may have some concerns. Some examples:

- You’re raising money to buy a gift: make sure those paying towards it to use the name that corresponds with your account.

- You’re opening a Tall Oaks Savings Account for your newborn baby and have put the account number on the birth announcement card: that account is in the name of the parent(s), so you need to provide the name that goes with the account number (i.e. not the baby's name).

To avoid any doubts, advise those paying you always to use the name that corresponds with the account. When they do, a green shield will appear.

Frequently asked questions about instant credit transfers

When you make a traditional credit transfer, the money is into the payee's account no later than the next banking day.

When you carry out an instant credit transfer (always in euros), the money is credited to the payee's account within seconds (10 at most), 24/7 (including at night, on weekends, public holidays and bank holidays).

This could be due, for instance, to a technical problem because the payee's bank doesn’t accept instant credit transfers or because the payee's account has been closed.

Instant credit transfers are carried out at no extra charge.

The money is available to the payee in seconds when transferred this way.

Yes, instant credit transfers can be made to foreign account numbers within SEPA*, provided the payee's bank is able to receive this type of transfer. Overview of countries where banks must be able to receive instant credit transfers:

- EEA (euro): mandatory from 9 January 2025

- EEA (other than euro): mandatory from 9 January 2027

- Other SEPA countries: optional

More detailed information can be found in this EPC Document.

*Find out more about SEPA at What is SEPA? What does it entail for me as a business owner? – KBC Brussels Banking & Insurance

Euro-denominated payments made from a euro payment account within SEPA are already possible.

The following capabilities will become available in the future:

• Euro-denominated payments from a non-euro payment account within SEPA

• Payments in payments diary (until then, scheduled payments will continue to be processed as traditional credit transfers. Saturdays and Sundays cannot currently be selected.)

• Standing orders (until then, standing orders will continue to be processed as traditional credit transfers. However, you can select a non-banking day and your account will be debited accordingly, but the payee's account will not be credited until the next banking day.)

No, it can't. The amount is credited to the payee’s account in a matter of seconds, which doesn’t give us time to cancel it. If you wish to cancel the payment, we advise you to contact the payee.

The same limits apply as for traditional credit transfers.

Yes, any KBC Brussels customer can carry out instant credit transfers using the online channels. As from 9 October 2025, you can choose between instant and traditional credit transfers in KBC Brussels Mobile and KBC Brussels Touch. Starting 27 October 2025, you can also go to your bank branch and make an instant credit transfer.

The channels where you currently have this choice will be expanded further in the near future. At present, you also have the option of transferring money instantly in KBC-Online for Business, the KBC Business app and KBC Reach.

Yes, they can. As from 9 October 2025, instant credit transfers will be possible from any type of euro payment account held at KBC Brussels.

Yes, KBC Brussels has long supported instant credit transfer processing, thus enabling you to receive such transfers on your KBC Brussels accounts. The processing speed (instant/traditional) is always provided in the transaction details.

KBC Brussels Mobile & KBC Brussels Touch

As from 9 October 2025, unless otherwise stated.

At KBC Brussels, you can choose between instant and traditional credit transfers. All transfers in KBC Brussels Mobile and KBC Brussels Touch are processed as instant credit transfers by default.

If you adjust the execution speed in the general settings, that setting will be applied to all new credit transfers.

You can always adjust the speed for transfers on an individual basis when they are to be carried out.

If an instant credit transfer fails, you can either cancel it or have it carried out as a traditional credit transfer.

You are free to choose the speed of execution for each one of your transfers.

If we fail to receive a status update on the initiated instant credit transfer within 10 seconds, you’ll see a screen notifying you that the status of the transfer is not yet known. However, as soon as its status comes through, you’ll be notified as follows:

• KBC Brussels Mobile: in a message displayed under ‘For you’ (as from 9 October 2025), via the newsfeed and a push notification (as from 9 December 2025 in both cases)

• KBC Brussels Touch: in a message displayed under ‘For you’ (as from 9 October 2025)

If the instant credit transfer ends up not going through, the amount concerned will be paid back into your account*.

*from 27 October 2025 (until then, the transaction will disappear from your account overview).

As from 9 December 2025, both instant and traditional credit transfer instructions you’ve included in the remittance folder will be carried out. Until 9 December 2025, transfer instructions in the remittance folder will always be processed instantly and, if this isn’t possible, as traditional credit transfers without you having to intervene.

As from 9 December 2025, both instant and traditional credit transfer instructions you’ve included in the remittance folder will be carried out. Until 9 December 2025, transfer instructions in the remittance folder will always be processed instantly and, if this isn’t possible, as traditional credit transfers without you having to intervene.

Yes, they can. As from 9 December 2025, the person initiating the credit transfer can specify the processing speed. The last person to sign will then receive feedback on whether the transfer was successful or not.

If instant processing is not possible, the last person to sign can change the processing speed to that for a traditional transfer without the others having to sign again.

Until 9 December 2025, transfers requiring more than one signature will always be processed instantly. If that isn’t possible, they’ll automatically be processed as traditional credit transfers, i.e. without you having to intervene.

Payments made through your bank branch

From end November 2025

The default execution speed for credit transfers made through your bank branch is that for traditional transfers. If you want to make an instant credit transfer at your bank branch, the staff member there can initiate the transfer for you. After the transfer instructions have been entered, the member of staff will receive feedback on the status of the transfer within 10 seconds, i.e. whether it’s been processed instantly or not. They will communicate that feedback to you right away. This means you must wait at the branch until the staff member can give you this information.

If we don’t receive feedback on time, the member of staff in the branch won’t be able to tell you right away if the transfer went through or not. In that case, you should contact your bank branch later. As soon as the status of your transfer comes through, the member of staff can contact you and tell you whether the instant credit transfer was successful or not.

If the instant credit transfer ends up not going through, the amount concerned will of course be paid back into your account.